Farming has never been easy, but 2026 is shaping up to be one of the most financially challenging years yet. With input costs like fertilizer, fuel, and machinery still high, and crop prices showing little sign of catching up, many farms are forced to rethink how they manage every dollar. The pressure is real, especially for those running a small farm budget, where there’s little room for error.

For many farmers, the goal isn’t just to get through the season; it’s to find stability and protect their margins. That’s where a smart, practical farm budget becomes essential. A reasonable farm budget doesn’t just track numbers; it helps answer critical questions: What’s turning a profit? Where are the hidden costs? What can be adjusted without putting yield or quality at risk?

In this blog, we’ll break down how to build a farm budget that reflects real costs, adapts to change, and helps you stay in control, no matter how unpredictable the season gets.

The State of Farm Economics in 2026

Margins are tightening, but not in ways that are easy to predict. This year, some input costs, like feed, are easing, while others, such as livestock purchases, fuel, and equipment, remain volatile. It’s no longer just about managing high costs but navigating uneven ones that shift with little warning.

That unpredictability is precisely why a static farm budget made at the start of the year no longer holds up. When expenses rise unevenly across crops, livestock, and infrastructure, farmers need tools that help them adjust quickly. A working farm budget today isn’t just a forecast; it’s a live document that reflects what’s happening on the ground.

At the same time, global market shifts, climate disruptions, and new policies continue to reshape the farm economy as the year unfolds. The producers holding their ground aren’t just reacting; they’re making faster decisions, testing trade-offs, and using farm budgeting to stay financially stable, not just compliant.

Did You Know?

The USDA projects a $2.5B drop in farm expenses for 2025, mostly from lower feed costs. But with livestock costs rising, a mid-season farm budget review can make the difference between staying ahead and falling behind.

Choosing the Right Budgeting Method for Your Farm Operation

There’s no one-size-fits-all approach to building a farm budget. What works for a grain-focused operation may fall short on a diversified farm with livestock or one juggling seasonal cash flow swings. That’s why choosing the proper budgeting method is extremely important, especially for couriers managing variable fuel, maintenance, and delivery costs.

Choosing the right budgeting method starts with understanding what your farm actually needs to manage. Are you worried about covering bills during off-season months? Comparing the ROI of each crop? Or simply trying to stop surprise expenses from blowing your margins?

Each of these situations points to a different tool. Here are the types of farm budgets every grower should know, and when to use them.

1. Whole-Farm Budget

This is your big-picture plan. It totals up all farm income and expenses across the year, giving you a full view of whether the business is financially sustainable. This is the place to start if you’re trying to secure financing, plan long-term investments, or assess your overall profitability.

Use it when:

- You’re planning for expansion or transition

- You want a year-end profitability snapshot

- You’re applying for loans or support programs

How a farm can benefit or use this: A large-scale grain farm, like one growing corn or soybeans over 500+ acres, can use a whole-farm budget to map total revenue from crop sales against expenses like seed, fertilizer, and equipment. This helps show overall financial health, making it easier to secure loans for land purchases or new machinery.

2. Cash Flow Budget

Margins can look good on paper, but still run dry in real time. A cash flow budget helps you track when money comes in and goes out, so you’re not left short during peak expense months. It’s especially useful for farms with seasonal income, staggered input costs, or heavy loan payments.

Use it when:

- You need to time input purchases or labor

- You have gaps between income and expense cycles

- You’re trying to avoid last-minute borrowing

How a farm can benefit or use this: A small vegetable farm, such as one selling at farmers’ markets over 10–50 acres, can benefit from a cash flow budget by tracking spring planting costs (seeds, labor) against summer sales revenue. This ensures they don’t overspend early in the season. They can plan for cash shortages, like negotiating delayed payments with suppliers or timing labor hires to avoid borrowing during lean months.

For owner-operators whose household mortgage payments create early‑season cash gaps, consider restructuring personal debt alongside your farm cash flow plan. Working with Griffin Funding to refinance or secure a home loan with lower monthly payments can free operating cash, better align due dates with your revenue cycle, and reduce the need for short-term borrowing during planting or feed‑heavy months. Build any new payment schedules and interest costs into your monthly cash flow budget so projections match reality.

3. Farm Enterprise Budget

Not every part of your operation pulls equal weight. A farm enterprise budget breaks things down by crop, herd, or product line. It shows you which parts are profitable and which are dragging things down. For diversified operations, this is key to understanding where to grow and where to cut back.

Use it when:

- You manage multiple crops or livestock units

- You want to compare returns between enterprises

- You’re debating whether to expand or retire an activity

How a farm can benefit or use this: A diversified farm, combining crops like wheat and livestock like poultry or cattle, can use an enterprise budget to compare profitability across each operation. For example, a mid-sized farm (100–300 acres) can analyze whether poultry feed costs outweigh profits compared to other species or crop types. This helps decide whether to expand a profitable crop, reduce a loss-making herd, or adjust inputs to improve margins, ensuring resources focus on what drives returns.

4. Monthly Budget

Simple, fast, and surprisingly effective. Monthly budgets give you tighter visibility and help you catch issues early, before they become full-year problems. They work well for smaller or medium-sized farms that want regular control without building complex forecasting models.

Use it when:

- You prefer a hands-on, short-term view

- Your costs and income vary frequently

- You want better visibility without heavy tracking

How a farm can benefit or use this: A small organic farm, like a 5-20 acre berry or vegetable operation, can use a monthly budget to monitor fluctuating costs, such as fuel for deliveries or seasonal labor. By checking monthly expenses against projections, the farm can quickly spot overruns and adjust, like optimizing worker schedules or cutting non-essential costs, to keep the season’s budget on track.

Once you’ve identified the budget style that fits your operation, the next step is selecting the right financial tools. This guide on choosing financial software for farmers helps map software options to your farm’s size, complexity, and goals.

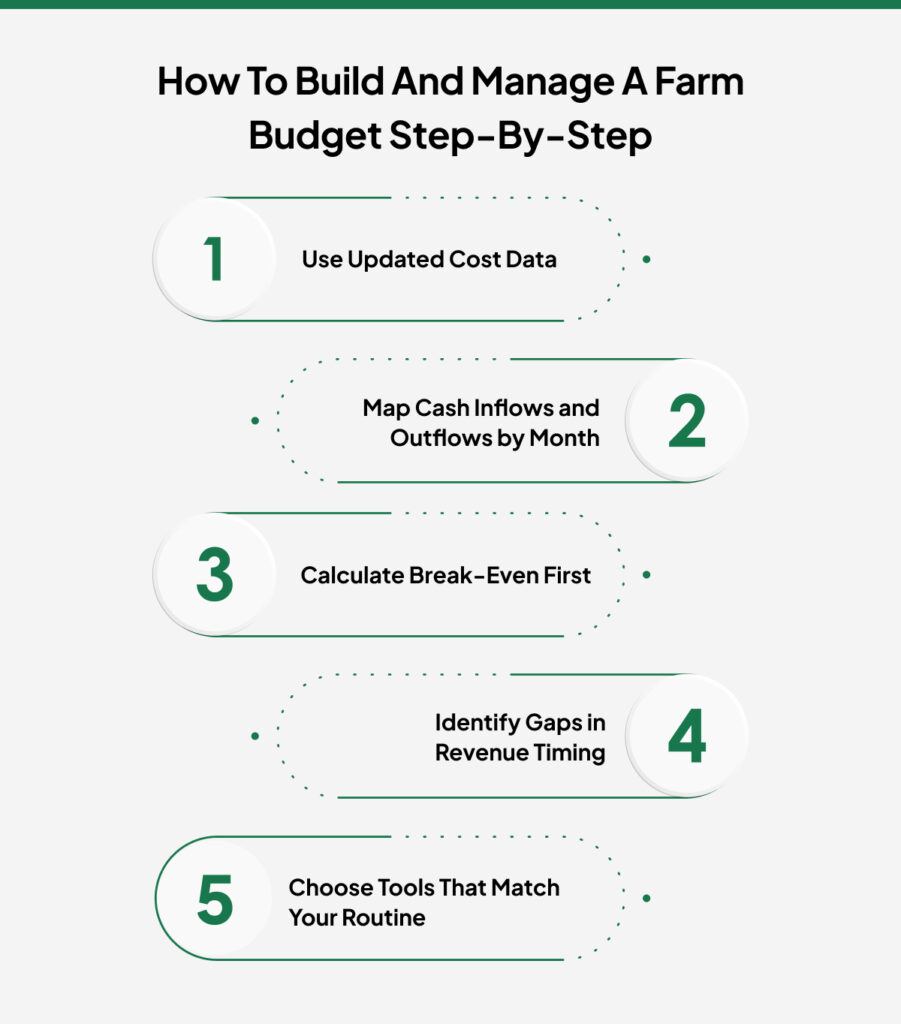

How to Build and Manage a Farm Budget Step-by-Step

Modern challenges haven’t made financial planning easy. Prices swing fast, supply chain delays crop up without notice, and farm margins are being squeezed from both ends. That’s why your farm budget can’t just be a one-time spreadsheet. It has to be something you can return to, adjust, and rely on, like a tool, not a report.

Here’s how farmers are handling it this year, and what you can take from it.

Use Updated Cost Data

Your last season’s records are a starting point, not a blueprint. Input costs (especially fertilizer and fuel) continue to fluctuate monthly. Start by anchoring your farm budget in current supplier rates, confirmed labor availability, and average yields, not just ideal ones.

If you manage broilers, for example, your poultry farm budget should consider real feed volatility, not just historical averages. Feed may have softened in price nationally, but local costs and delivery timelines habitually disrupt the assumptions.

Map Cash Inflows and Outflows by Month

It’s not just how much you’ll spend, it’s when. Many small and mid-sized farms get caught in early-season cash gaps because they overcommit in Q1 and assume revenue will come in Q3. Map out your timing. Know when cash dries up and when it flows in. If that gap’s too wide, tighten spending or renegotiate supplier terms. A farm budget without timing will not serve anything.

Calculate Break-Even First

Many farmers ask, “Should I plant more?” or “Can I add a third flock this year?” But unless you’ve mapped your break-even clearly, more volume means more risk. Before you commit to new acres, inputs, or livestock, calculate how much income it takes to cover your base. Then work backwards.

Identify Gaps in Revenue Timing

Here’s a quick farm budget example:

You’re projecting $90,000 in poultry income by July, but you know $62,000 in feed and utilities will hit by May. That gives you a 2-month gap, and it’s a red flag. That might mean shifting to fewer but faster-yielding flocks or delaying equipment payments. Budgeting is less about predicting the future than seeing the problem early enough to act.

Choose Tools That Match Your Routine

Every farm runs differently, and your budgeting tools should reflect that. Some growers rely on pen and paper, others use spreadsheets built into their daily logs. But as operations become more layered, many find value in simple farm financial management tools that bring everything, costs, income, and records, into one place. Tracking operational expenses accurately helps ensure the budget reflects the true cost of running the farm. It’s not about changing how you work; it’s about making your farm budget easier to maintain, more accurate, and ready when it matters most.

Strategies to Cut Costs Without Compromising Yield

Once you’ve mapped your numbers and understand where your money is going, the next step is making adjustments that protect your margins without hurting performance. That means focusing on decisions that improve efficiency, not just reduce spending. Cost-cutting only works when it’s tied to impact, and in farming, every cut has to be measured against yield, timing, and risk.

Here’s what that looks like in practice.

Evaluate Input ROI by Field

Start with what you’re spending the most on. It’s not about cutting back on fertilizer or seed, it’s about knowing what you’re actually getting in return. You’re likely overapplying somewhere if you haven’t measured response rates by field or zone. If you have, trust your data. Variable-rate applications don’t just reduce costs, they prevent input waste that doesn’t move yield.

Review Equipment Costs by Return

Machinery is one of the most expensive pieces of any farm budget, and often the least questioned. Run the numbers: if you’ve got a $100K+ sprayer used 4 weeks a year, ask if that same job could be done via custom work or leasing. It’s not about losing independence, it’s about whether capital tied up in steel could be working harder elsewhere.

Be Aggressive With Season Timing

One of the most overlooked ways to control costs is more brilliant timing, not just of operations, but also of procurement. Can you negotiate early buys with price locks? Are you applying nitrogen at the best uptake window, or just when labor is free? Aligning the application with biological demand, not calendar habits, can improve yield while cutting waste.

Catch Mid-Season Budget Drift Early

Many farmers build a farm budget in December and never look at it again. By July, costs have shifted, and decisions are still being made on January numbers. If you’re not checking actuals vs. projected monthly, you’re budgeting blind. A simple farm budget calculator can help track actual costs per unit and flag early overruns before they eat your margins.

Know What’s Optional When Cash Gets Tight

In tight years, it helps to label every planned cost in one of three buckets: essential, productive, or discretionary. Essentials keep the lights on. Productive expenses drive yield or quality. Discretionary costs, like deferred upgrades or non-core trials, can be paused if cash tightens. This framework avoids panic-cutting in-season and protects output when it matters most.

Cutting costs sets the foundation, but it’s not enough. The real advantage comes when technology helps you track spending, spot problems early, and make faster, clearer decisions with your budgeting.

Technology’s Role in Farm Budget Planning to Increase Profit

Even with a solid plan, most farm budgets fall out of sync once the season ends. Costs shift, timelines move, and new decisions pop up weekly. What used to be a straightforward budget becomes a scramble to keep things aligned. And when that happens, guesswork fills the gaps, often at the cost of margin.

This is where the right technology pays off, not by automating your instincts, but by giving you a clear picture of your numbers, even while the day-to-day keeps moving.

How Folio3 AgTech Farm Accounting Software Helps

Folio3 AgTech farm accounting software is built to match the pace of farm life, helping you manage your finances without sacrificing time or visibility.

Here’s how it supports your budgeting every step of the way:

- Track income and expenses in real time across crops, livestock, and multiple locations

- Automate vendor payments and recurring costs, and reduce manual follow-up

- Monitor inventory of seed, feed, and supplies without second-guessing.

- Analyze production costs per acre or herd, and identify where margins are getting tight

- Stay ready for audits and tax season with clean records, GAAP compliance, and reports.

- Access your full financial picture anytime, whether you’re at the office or off-grid in the field

This makes it ideal not just for farm data management but also as a core part of your farm inventory management, aligning with USDA standards.

“I used to sit down with my budget once a month and hope it matched up. Now I know where I stand every day.”

— Feedback from a grower using connected farm accounting tools

For farms comparing tools before making a switch, a detailed comparison of theseven best farm accounting software in 2026 breaks down key features that matter for day-to-day budgeting, tracking, and reporting.

Conclusion

Farm success has always depended on timing and good judgment, and the room for error has narrowed. A reliable budgeting plan helps you stay steady when prices and inputs change, or seasons shift unexpectedly. It’s not just about cutting costs, it’s about staying in control.

The right tools give you a clear view of your finances, help you adjust faster, and support better decisions throughout the year. When your numbers, costs, payments, and cash flow are connected, you’re not reacting to problems; you’re staying ahead of them. And that’s what long-term success in farming looks like: being ready, flexible, and using every dollar wisely.

FAQs

How Often Should I Review My Farm Budget During The Year?

Revisit it monthly at a minimum. Real-time tracking is best, especially during planting and harvest, when costs and decisions shift quickly.

What’s The Best Way To Control Costs Without Lowering Yield?

Start by tracking cost per unit, not per acre. Then cut inputs that don’t show return, not those that drive yield.

Can Small Farms Benefit From Farm Accounting Tools?

Absolutely. The right tools help small farms avoid cash gaps, reduce manual errors, and stick to a clear farm budget even with limited staff or time.

What Should I Include When Building My Budget?

Account for all fixed and variable costs, income timing, debt payments, and capital needs. Remember to plan for emergencies.

What’s The Value Of Linking Accounting To My Farm Plan?

It keeps your budget grounded in day-to-day reality, helping you make faster, better decisions before issues grow into problems.