A farm risk management plan is fundamental to resilience and prosperity for farm businesses in the complex agricultural sector. Farmers can sense uncertainty when observing fluctuating market prices or weather trends.

Arming farmers with agricultural management practices will be highly beneficial, considering the widespread nature of risk in farm operations. Using a complete farm risk management plan is of utmost importance for new and beginning farmers.

Farmers initially face an overwhelming array of uncertainties that can affect their farm’s profitability. These might include varying input and output prices, technological trends, weather conditions, and fluctuations. Different risks should be recognized and managed at every farming stage, from sowing to selling.

By exploring such risks, farmers can learn to identify the sources and extent of risks that their farms experience. Then, they will devise problem-solving strategies to respond to the challenges and ensure their financial security.

So, keep reading this blog to delve into the intricacies of a farm risk management plan that aims to empower new and seasoned farmers to cultivate resilience, seize opportunities, and thrive amidst uncertainty in the ever-evolving agricultural landscape.

Understanding Agricultural Risks

Understanding and effectively managing these risks are critical for farm businesses to thrive in an increasingly volatile and unpredictable agricultural landscape.

By implementing a proactive farm risk management plan and building resilience, farmers can mitigate the adverse impacts of these risks and position themselves for long-term success.

However, agricultural operations are exposed to various types of risks, each posing unique challenges to farm businesses:

Market Risks

Fluctuations in commodity prices, volatility of demand, and changes in consumer preferences cause market risks. Farmers are exposed to the fluctuating nature of the market, which may turn out to be their worst enemy, as it decreases the profitability of what they grow or rear.

Issues like the evolution of global trade dynamics, supply and demand imbalances, and changes in consumer market trends conjure upmarket risks.

Production Risks

Production risks are factors that can negatively affect crop yields or livestock productivity. Negative impacts include rain shortages due to droughts, floods, cold, pest and disease outbreaks, and system failures. Reduced production may result in lower yields, poor-quality products, and additional input costs for farmers.

Financial Risks

Financial risks entail managing cash flow, debt obligations, and accessing credit. Shifts in cost inputs, interest, and exchange rates may affect farm fortunes and economic stability.

Other risk determinants include high levels of debt, inadequate or no insurance cover, and insufficient liquidity, which threaten a farming enterprise’s success. Another important aspect to consider in managing farm-related financial risks is long-term income security and legacy planning. Tools like Indexed Universal Life (IUL) insurance can support both wealth accumulation and protection, offering flexibility and lifelong coverage tailored for your financial goals. Farmers looking to ensure family stability, supplement retirement, or protect business succession may find that evaluating who should buy IUL insurance aligns with broader farm risk strategies.

Environmental Risks

Environmental risks include global warming, soil erosion, water scarcity, and pollution. These risks directly affect agricultural productivity by damaging soil fertility, water availability, and the health of crops or livestock. Environmental norms and sustainability issues determine how farming is done and the production costs.

The Impact of These Risks on Farm Businesses

The impact of these risks on farm businesses can be significant and multifaceted:

- Reduced Profitability: Unstable market conditions and production problems can lower revenues and raise expenses, ultimately reducing business profitability.

- Operational Disruptions: Environmental hazards, including extreme weather conditions and crop diseases, are the farmers’ fears involved in production. Such harms result in disrupted activities, loss of crops, delayed planting or harvesting, and increased labor and input costs.

- Financial Instability: Financial risks, such as loss of liquidity or debt problems, can undermine farm operations, forcing farmers to deal with such topics as meeting financial settlements, investing in growth opportunities, or overcoming economic failures.

- Environmental Degradation: Environmental hazards can spoil natural resources and ecosystem services necessary for agricultural production. Thus, such activities will be unsustainable in the long term, and they will not be able to be supported.

Core Components of a Risk Management Toolkit

The core components of a farm risk management plan encompass various strategies and tools aimed at mitigating financial risks inherent in agricultural operations:

Financial Risk Management:

Budgeting and Cash Flow Management Strategies

Budgeting includes revenue and expense forecasting and expenditure control so that money may be appropriately used and the farm is in total financial health. Farmers can draw up annual budgets to cover operation expenses, debt payments, equipment investments, and contingency funds when creating a farm risk management plan.

Cash flow management strategies aim to achieve the best timing of cash inflows and outflows to keep liquidity high and meet all financial obligations. This could include techniques like modified procurement, contributing to the manufacturer’s flexibility on bill payments, or arranging credit for seasonal cash flow variances.

Crop Insurance Options and Their Benefits

Crop insurance reduces crop yield losses due to adverse weather, pests, diseases, and other non-controllable causes. As a part of a farm risk management plan, farmers can use crop insurance options, such as yield-based, revenue-based, or area-based coverage, to protect themselves against production risks.

Crop insurance is an essential tool for farmers because it reduces the adverse financial impact of unfavorable weather conditions and market fluctuations, which means stability and resilience in their businesses.

Diversifying Income Streams

On the other hand, diversification involves building recent income sources that require much more agricultural production replacement. This makes it possible to reduce dependence on a single business and distribute risks across several activities.

With a farm risk management plan, farmers can earn more money by adding value to their products, such as processed foods, artisanal goods, or crops with higher profit margins. In addition, agritourism activities, including farm tours, educational workshops, or recreational events, can be a good profit generator, encourage visitation, and attract visitors.

Utilizing Financial Tools for Risk Assessment and Mitigation

Farmers can use financial instruments and other resources to evaluate and reduce risks with a farm risk management plan. Financial ratios, such as liquidity, solvency, and profitability ratios, give a glimpse into farm businesses’ financial health and performance.

Risk assessment tools, such as scenario analysis and sensitivity analysis, could help farmers realize the significance of different forms of risk to their financial performance. Crop economists, agricultural extension services, and financial advisors also provide counseling and advice on economic issues based on the personal needs of production firms.

Production Risk Management

Implementing Sustainable Farming Practices

Adopting sustainable farming practices like taking good soil care and applying crop rotation can decrease the limiting factors affecting production. By increasing soil fertility, structure, and water retention, farmers can enhance crop resilience and mitigate the impact of adverse weather conditions or pest pressures.

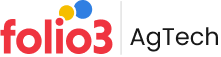

Utilizing Technology for Monitoring

Farmers can now keep tabs on their fields by using crop management software with the help of real-time weather updates, pest tracking, and remote sensing capabilities so that they can know when to intercept any possible danger and take timely actions to avert any risks.

Developing Contingency Plans

Weather extremes, such as pest and disease outbreaks, are contingency plans that should be devised to reduce production disruptions. Farmers can consider having a response protocol, an alternative cropping strategy, and a resource allocation plan for future unplanned occurrences so that production can continue smoothly.

Building Relationships with Extension Services

Building connections with the local agriculture extension service guarantees that the farmers are conversant with the experts, secure resources, and have support for risk management across production.

Extension services guide pest management strategies like using a software for pest management, disease prevention measures, and best practices for sustainable agriculture, enabling farmers to make the right decisions and increase their resilience in farming operations.

Market Risk Management

Understanding Market Trends

Farmers mitigate market risks by staying abreast of trends, identifying profitable niches, and aligning production accordingly.

Negotiating Fair Contracts

Negotiating contracts with fair pricing and risk-sharing mechanisms helps farmers hedge against market volatility and ensure profitability.

Exploring Direct Marketing Channels

Farmers reduce reliance on intermediaries by exploring direct marketing channels such as farmers’ markets and CSAs, enhancing control over pricing and market access.

Building Relationships with Buyers

Establishing relationships with distributors and buyers secures stable markets for farm products, mitigating the impact of market fluctuations and enhancing business sustainability.

Legal and Regulatory Risk Management

Understanding Laws and Regulations

Farmers mitigate legal and regulatory risks by understanding farm-related laws, such as environmental compliance and labor regulations, to ensure adherence and avoid penalties.

Obtaining Necessary Permits

Obtaining necessary permits and licenses ensures legal compliance and mitigates the risk of regulatory violations, safeguarding farm operations from legal consequences.

Considering Business Structures

Considering business entity structures, such as sole proprietorship or LLC, and their implications helps farmers protect personal assets, manage liability, and comply with tax obligations.

Consulting with Legal Experts

Consulting with agricultural lawyers provides farmers expert guidance on legal matters and risk mitigation strategies. It also helps them navigate complex regulatory frameworks, enhance legal compliance, and protect farm interests.

Technological Solutions for Risk Management

The technological solutions in significant agriculture management, including crop management software, present farmers with powerful tools to heighten their decision-making capabilities and control routine operations.

EcoDocs is crop management software with innovations like geo-fencing for more innovative farming and real-time weather monitoring. It allows farmers to make well-informed decisions, thus optimizing crop outputs. With Ecodocs, you can experience advanced farming foresight and cultivate success.

With smooth task scheduling and online audits, EcoDocs offers a 100% advanced solution that overhauls farm management. This leads to time-resource-saving and compliance-proof operations from seed to final product consumption.

Financial Planning and Management

Strategies for Financial Planning to Manage Economic Risks

Diversification of Income Sources

Income diversification could reduce economic risk by diminishing the vulnerability to market fluctuations and uncertainties in one revenue stream.

Farmers may consider value-added products, such as unique goods, agritourism, or an alternate crop, to improve their income sources and absorb shocks during price fluctuations.

Building Emergency Funds

Creating emergency funds or contingency reserves is a financial safety net that can be used in case of economic crisis or unexpected expenses.

Using the earnings for emergency rooms provides liquidity and resilience, enabling farmers to keep going even after emergencies without compromising their long-term sustainability target.

Managing Debt Wisely

The careful handling of household debt is critical to providing insurance against the economic effects and maintaining the finances’ stability. Farmers must consider the need for borrowing, negotiate favorable loan terms, and avoid over-leverage.

Keenly using bank loans in an investment that generates income or is an area of improvement in operations may keep the business’s profit consistent with minimal financial risk.

Continuous Monitoring and Adjustment

Frequent tracking of financial productivity, market evaluation, and fluctuations is a tool that allows farmers to spot risks and eventually change their strategies.

Farmers can be proactive in their financial planning by keeping updated with changes in input costs, commodity prices, and market demand. Thus, they can minimize economic risks and maximize the benefits of emerging opportunities.

Budgeting and Forecasting as Crucial Tools for Financial Risk Management:

Budgeting and forecasting are essential tools for farm risk management plans, providing farmers with a structured approach to planning and decision-making:

Budgeting

A well-structured budget is essential as it enables the farmer to predict income and expenses, allocate resources wisely, and set financial goals.

By analyzing the existing budget based on past sales figures and projecting market trends, farmers discover possible losses, determine the hierarchy of expenses, and use limited resources to their best advantage to achieve the highest economic efficiency.

Forecasting

Financial forecasting involves projecting the anticipated future income, outflow, and cash flow figures based on present trends and assumptions. TFarmerscan predicts potential problems through regular forecasts, consider different cases and creates plans to counter financial risks.

The outlook lets farmers make effective decisions earlier, manage their financial resources prudently, and develop a strategy that will enable them to weather the challenges, turning agriculture into a more profitable undertaking.

Market Analysis and Strategy

Market analysis is pivotal in a farm risk management plan, offering a compass through shifting landscapes. Farmers decode trends by delving into market intricacies, foreseeing pitfalls and potentials. Through this lens, they:

- Navigate Trends: Like seasoned sailors reading the wind, farmers track market currents, spotting emerging waves and lurking whirlpools. This vigilance guides adjustments, ensuring smooth sailing amidst changing tides.

- Gauge Risks: Market analysis erects a lighthouse, illuminating hazards like price squalls and demand tempests. With this foresight, farmers plot routes, diversify channels and fortify against financial storms.

- Forecast Demand: Market scrutiny acts as a weather vane, capturing gusts of consumer preferences and shifts in market atmospheres. Harnessing this insight, farmers tailor offerings, ensuring a steady course through evolving landscapes. For agtech vendors or farm management platforms looking to increase their visibility in a competitive B2B market, leveraging Enterprise SaaS SEO strategies can support organic growth and help attract the right farming and co-op clients through search.

Developing a Marketing Strategy to Minimize Price Risks:

Developing a robust marketing strategy is essential for minimizing price risks and maximizing profitability in agricultural operations:

- Diversify Market Channels: Expanding beyond single outlets buffers against price fluctuations. Farmers tap into diverse avenues like farmers’ markets, CSAs, online platforms, or local partnerships, spreading risk and steadying income.

- Implement Pricing Strategies: Strategic pricing anchors profitability amidst market turbulence. Farmers optimize competitiveness and shield revenue from price volatility by aligning prices with costs, demand, and value propositions.

- Utilize Risk Management Tools: Leveraging tools like contracts, futures, options, or insurance hedges against price swings. Securing prices or safeguarding against losses fortifies revenue stability, ensuring financial robustness in uncertain markets.

- Build Strong Relationships: Nurturing buyer and distributor alliances fosters stability in turbulent markets. Long-term partnerships yield insights, fair pricing, and dependable channels, fortifying against price gyrations and enhancing market resilience.

Government Support and Resources

Available Programs for New and Beginning Farmers

- USDA Beginning Farmer and Rancher Development Program: Provides education, training, and technical assistance.

- Farm Service Agency (FSA) Loans: Offers low-interest loans for land purchases, equipment purchases, and operating expenses.

- USDA Microloans: Provides smaller loans with flexible requirements for new and small-scale farmers.

- Conservation Reserve Program (CRP): Offers financial incentives for implementing conservation practices on agricultural land.

Accessing and Utilizing Government Programs

- Research programs through USDA compliance and state agricultural departments’ websites.

- Attend workshops or webinars hosted by government agencies to learn about program eligibility and application procedures.

- Contact local FSA offices or agricultural extension agents for personalized assistance and guidance.

- Prepare required documentation and keep detailed records to support program applications.

- Stay updated on program changes and deadlines to utilize available resources effectively.

Building and Implementing Your Toolkit

Here’s how you can develop and implement your farm risk management plan:

Identify Your Unique Risks

Tailoring the farm risk management plan to address specific farm operation risks is crucial. Each farm faces challenges, weather-related risks, market fluctuations, or production uncertainties. By conducting a thorough risk assessment, farmers can pinpoint their vulnerabilities and tailor strategies to mitigate them effectively.

Prioritize Strategies

Guide readers to prioritize farm risk management plan and strategies based on their impact and likelihood. Some risks may have a higher probability of occurrence or pose a more significant threat to the farm’s sustainability.

Encourage farmers to address these priority risks first, ensuring that limited resources are allocated efficiently to mitigate the most critical threats.

Develop Action Plans

Encourage readers to develop concrete action plans for implementing the chosen farm risk management plan and strategies. Action plans should outline specific steps, timelines, and responsible parties for each strategy. Task management tools can be helpful in tracking these steps, ensuring that each task is completed on time and by the right person.

Farmers can effectively execute their farm risk management plan, strategies, and initiatives and monitor progress by breaking the implementation process into actionable tasks.

Continuously Monitor and Adapt

Stress the importance of regularly reviewing and updating the risk management toolkit as circumstances change. Farming environments are dynamic, with risks evolving. Encourage farmers to continuously monitor market trends, weather patterns, and other relevant factors.

Farmers can proactively adjust their farm risk management plan and strategies by staying vigilant and adaptable to effectively mitigate emerging threats and capitalize on new opportunities.

Conclusion

This blog has emphasized the importance of a proactive farm risk management plan for new and beginning farmers. By identifying unique risks, prioritizing strategies, developing action plans, and continuously monitoring and adapting, farmers can build practical risk management toolkits tailored to their operations.

New farmers need to understand that managing risks is integral to the sustainability of their businesses. By implementing these strategies, farmers can navigate challenges, capitalize on opportunities, and ensure the long-term success of their farm ventures. Embracing a farm risk management plan as a fundamental practice will empower new farmers to thrive in the dynamic agricultural landscape.

FAQs

What are Risk Management Strategies in Agriculture?

Risk management strategies in agriculture involve identifying, assessing, and mitigating potential risks to farm operations. These strategies include diversification, insurance coverage, hedging, forward contracting, adopting sustainable practices, and utilizing financial tools.

What are Some Risk Management Strategies?

Some common risk management strategies in agriculture include crop diversification, purchasing insurance policies (such as crop insurance), implementing sustainable farming practices to mitigate environmental risks, maintaining emergency funds, and utilizing risk management tools like futures contracts or options.

How Can We Manage Agricultural Production Risk?

Agricultural production risk can be managed through various strategies such as diversifying crops, implementing crop rotation and intercropping, adopting advanced technologies for monitoring and management, maintaining soil health, practicing water conservation, and having contingency plans for weather-related disruptions.

What Are the Risk Factors of Agriculture?

Risk factors in agriculture include weather-related risks (such as droughts, floods, or storms), market fluctuations (changes in commodity prices), input price volatility (fluctuations in fuel, fertilizer, or seed costs), pest and disease outbreaks, regulatory changes, and financial risks (debt burdens, interest rate fluctuations).

Which is the Most Common Risk in Farming?

The most common risk in farming varies depending on factors such as location, type of farming, and market conditions. However, weather-related hazards, such as droughts, floods, and storms, are often considered among the most common risks farmers worldwide face.

What is the Biggest Risk to Agriculture?

The biggest risk to agriculture can also vary based on various factors. However, some risks often considered significant include climate change and its effects on weather patterns, water availability, and extreme weather events.

What are the Primary Benefits of a Farm Risk Management Plan?

A farm risk management plan enables farmers to capitalize on opportunities, optimize profitability, and maintain stable income streams, contributing to agricultural enterprises’ overall viability and success.