Running a farm requires balancing weather, markets, and finances. U.S. agriculture is dominated by small operations; about 86 % of U.S. farms are small family farms operating 41 % of farmland and producing 17 % of national output, and most farm households rely on off‑farm income. Even so, the USDA forecasts that average net cash farm income will rise to about $127,000 per farm business in 2025.

Therefore, keeping clear financial records is critical to know where you stand and to satisfy lenders, partners, and the IRS. This comparative guide demystifies cash vs. accrual accounting, the two main methods used in U.S. farm accounting, by explaining their basics, differences, and trade‑offs.

Farmers, ranchers, accountants, agribusiness managers, and start‑ups will learn when each method fits, what records to keep, and how to choose a system that reflects their farm’s complexity, tax strategy, and growth plans.

What is Accounting for Farms?

Farm accounting encompasses the collection, organization, and interpretation of financial data specific to agricultural businesses. Unlike generic small‑business accounting, farm accounting must handle seasonality, biological assets, and fluctuating inventories from seeds and chemicals to stored grain and livestock. Because production occurs months before revenue arrives, farmers often prepay for inputs like fertilizer or seed and carry inventory through harvest.

These dynamics are complicated when revenue and costs should be recognized on the books, and key financial statements reported in farm accounting include:

Schedule F (Form 1040): The IRS form summarizing farm income and deductible expenses for tax purposes.

Balance Sheet: Shows assets, liabilities, and equity, critical for assessing farm solvency.

Accrual Income Statement: Reveals true profitability by matching revenues with the expenses incurred to generate them.

Cash Flow Statement: Helps plan and manage cash to cover inputs, payroll, and loan repayments.

Farm operations differ from typical businesses because they manage inventories that can be produced, stored, and sold later, receive subsidies after harvest, and rely on long-term assets like tractors and barns that depreciate over time. Effective farm accounting extends beyond tax filing; it enables better cash flow management, loan readiness, risk control, and long-term planning by aligning revenues with production costs.

Cash vs. Accrual Accounting: Understanding thie Basics

Farmers primarily use two methods of accounting:

Cash Accounting

Under the cash method, income is recognized when you receive cash, and expenses are deducted when you pay cash. Most farmers use cash accounting because it is simpler, and corporations or partnerships with average gross receipts under $30 million may elect cash rather than accruals.

For example, if you sell grain in December but ask the buyer to hold the check until January, the income is still considered received in December because you had constructive receipt. Likewise, prepaying fertilizer in November lets you deduct the expense when you write the check, not when you apply the product. Cash accounting aligns closely with bank statements, making it intuitive for small producers and helpful for tax management.

Accrual Accounting

The accrual method recognizes revenue when it is earned (for example, when a crop is ready for sale or livestock reaches market weight) and expenses when they are incurred, regardless of when cash changes hands. This approach matches revenues with the costs that generated them and provides a clearer picture of profitability across production cycles.

Suppose you purchase seed in December but don’t plant until spring; the cost should be recorded as a prepaid asset and expensed when the seed is planted. Accrual systems provide better management information but demand meticulous farm record keeping and more sophisticated software.

Difference Between Cash and Accrual Accounting

The key difference between cash and accrual accounting is the timing of when income and expenses are recognized. Cash basis recognizes transactions when money moves, while accrual basis records them when they occur economically.

Below is a summary of how key accounting dimensions differ under each method and the implications for farm management.

Cash vs. Accrual Accounting at a Glance

| Dimension | Cash Basis (farm context) | Accrual Basis (farm context) |

| Revenue timing | Recognize sales when cash is received; grain checks and livestock sales are income only when paid | Recognize revenue when the crop or animals are ready for sale, even if payment occurs later |

| Expense timing | Deduct expenses when paid, such as fertilizer or seed bills | Recognize expenses when inputs are used or liabilities incurred |

| Inventory handling | Inputs and harvested crops are not recorded as assets; purchases are expensed when paid | Track inputs and harvested crops as inventory assets and adjust for changes |

| Prepaid expenses | Prepayments are recorded as assets and expensed when consumed | High, flexible timing of receipts and payments can defer income or accelerate deductions |

| Receivables/payables | Not tracked; unpaid bills and uncollected sales are ignored | Accounts receivable and payable are recorded on the balance sheet |

| Seasonality smoothing | No smoothing; income and expenses spike when cash moves | Smoother income because sales are recorded when produced |

| Gross margin accuracy | May misrepresent profit when inventories build or shrink | More accurate gross margins by matching revenue and COGS |

| Tax planning simplicity | Limited income and expenses tied to economic events | Limited; income and expenses tied to economic events |

| Lender/GAAP alignment | Less aligned with Generally Accepted Accounting Principles | Preferred by lenders and adheres to GAAP |

| Record‑keeping complexity | Simple checkbook, single entry | Requires double-entry and inventory tracking |

| Management insight | Limited; it focuses on cash but obscures profitability | Strong; shows the true cost of production and profit |

| Typical farm profiles | Very small farms, sole proprietors, operations using Schedule F only | Growing farms, multiple enterprises, operations seeking loans, or required by the IRS |

Cash Method

The cash method suits very small farms, sole proprietors, and partnerships with simple operations or gross receipts under the IRS threshold. Farmers who primarily sell commodities at harvest and have limited inventories or prepaids may find cash accounting sufficient for day‑to‑day decisions and compliance.

Benefits:

- Simplicity and lower administrative burden: Bookkeeping mirrors checkbook activity and requires less training, reducing accounting costs.

- Clear cash picture: Because transactions are recorded when cash moves, farmers always know how much money is on hand for bills, wages, and investments.

- Tax flexibility: Timing receipts and payments can defer taxable income or accelerate deductions, offering some control over tax liability.

- Easier DIY bookkeeping: Many small operations can manage records in spreadsheets or basic software without professional assistance.

Limitations:

- Poor inventory matching: Cash basis expensing of inputs when paid means inventory and cost of goods sold (COGS) are not tracked; margins can be misleading.

- Misleading profitability in seasonal cycles: Income may spike at harvest and drop during planting, obscuring underlying performance and risk.

- Limited management insight: Without accounts receivable/payable, prepaids, or inventory, it is difficult to compare enterprises or identify cost drivers. Lenders often require accrual-adjusted statements for loans.

- Field/block performance is hard to isolate: Without matching revenues to specific production activities, evaluating profitability by enterprise or field is challenging.

Accrual Method

The accrual method is designed for growing farms with complex inventories, multiple marketing channels, contracts, or financing needs. Farms seeking outside investment or planning rapid expansion typically adopt accrual accounting to provide transparent financial reports.

Benefits:

- True margin visibility: Accrual matching of revenue and COGS produces reliable gross margins and enables enterprise-level profitability analysis.

- Better comparability across seasons: Recognizing production year earnings smooths seasonal volatility, making it easier to benchmark performance and make long‑term decisions.

- Preferred for lender/GAAP reporting: Accrual statements align with Generally Accepted Accounting Principles and are often required by lenders or investors.

- Stronger forecasting and cost control: Detailed data on receivables, payables, inventory, and depreciation improves budgeting and financial planning.

Limitations:

- Greater complexity: Double‑entry bookkeeping, inventory valuation, and accrual adjustments require trained staff or robust software.

- Inventory valuation discipline: Periodic counts of stored crops, feed, and supplies must be valued consistently, which can be time‑consuming.

- Higher bookkeeping/CPA costs: Professional accountants may be needed to ensure compliance and accuracy.

- Less intuitive cash view: Because profits are detached from cash flows, farmers need additional cash flow statements to manage liquidity.

How to Choose the Right Accounting Method for Your Farm

Selecting a farm accounting method is not one‑size‑fits‑all. Consider the following factors when deciding between cash, accrual or a hybrid approach:

1. Business size & complexity: Smaller operations with limited sales, few employees, and simple inputs can manage with cash accounting, especially when annual gross receipts are well below the IRS threshold. As gross receipts grow, multiple enterprises (crops, livestock, agritourism) emerge, and transactions become numerous, accrual accounting provides necessary transparency.

2. Inventory & input intensity: Cash accounting ignores inventory, which can be problematic for high‑input operations. If you store large amounts of grain, hay, or feed; have breeding livestock; or prepay significant inputs, accrual accounting or cash‑with‑accrual adjustments will better reflect your farm’s financial reality.

3. Financing & lender expectations: Lenders and investors prefer accrual statements because they reflect true profitability and solvency. When seeking loans, lines of credit or venture capital, accrual reports can speed approval and secure better terms. Even small farms may need accrual adjustments when working with Farm Service Agency (FSA) or local banks.

4. Tax strategy vs. management insight: Cash accounting offers flexibility to manage taxable income by shifting receipts or expenses between years. However, tax savings should not obscure weak operational performance. Many producers use cash accounting for tax reporting and then make accrual adjustments at year‑end to evaluate profitability and cost of production.

5. Systems & team capability: Accrual accounting requires disciplined recordkeeping, a chart of accounts, regular inventory counts and reconciliation of receivables and payables. Teams lacking accounting expertise or technology might struggle. Start with cash accounting and gradually incorporate accrual components such as tracking accounts payable while training staff and adopting software.

6. Growth trajectory: If you plan to expand acreage, diversify enterprises, or transition from hobby to full‑time farming, consider adopting accrual accounting early. It will support strategic planning, budgeting, and enterprise analysis. Farms expecting to cross the IRS gross receipts threshold should prepare for mandatory accruals well in advance.

7. Data quality & discipline: Accurate accounting depends on complete and timely records. Producers must track both business and personal expenses separately and reconcile accounts regularly. If record quality is inconsistent, start with a simplified cash system and focus on improving documentation before layering on accrual complexity.

8. Hybrid/transitional approaches: Many farms prepare tax records on a cash basis but adjust for changes in inventory, prepaid expenses, accounts receivable, accounts payable, and depreciation to create an accrual‑adjusted income statement at year’s end. This hybrid approach offers the best of both worlds: tax simplicity and management insight.

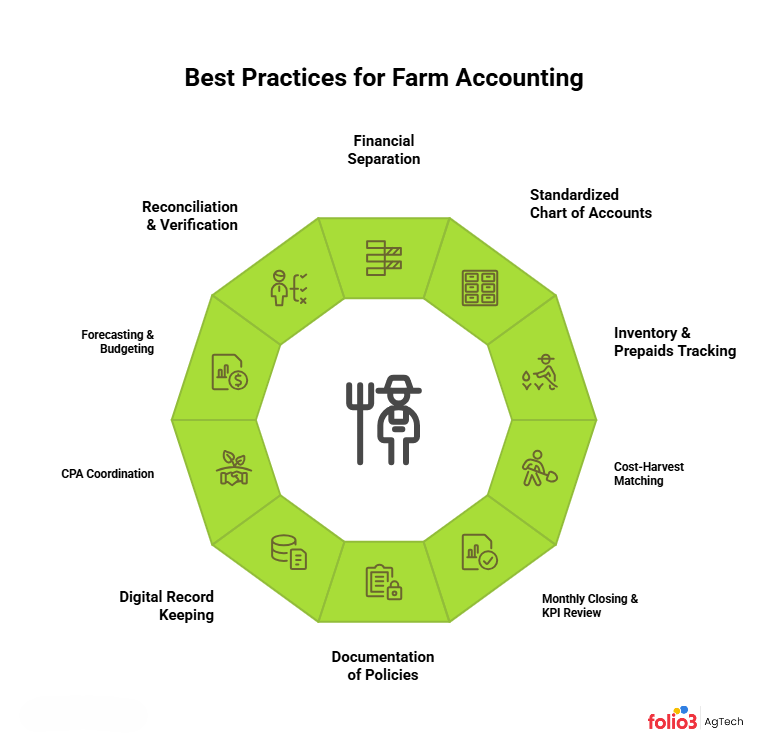

Farm Accounting Best Practices Every Grower Should Know

Implementing the right accounting method is only part of good financial management. Adopting sound practices helps ensure that records are accurate and actionable.

Separate Business & Personal Finances

Keep farm and household accounts separate. Accurate recording of all farm income and expenses requires separating personal and business transactions and reconciling farm accounts with bank statements. Open a dedicated business checking account and use business credit cards for farm purchases. Depositing off‑farm income into personal accounts while routing farm receipts through business accounts helps maintain clear boundaries and simplifies tax preparation.

Standardize Your Chart of Accounts for Farms

Develop a chart of accounts tailored to agriculture. The Farm Financial Standards Council recommends mapping revenue (by enterprise: corn, soybeans, hay, livestock) and expense categories (seed, feed, fertilizer, chemicals, labor, repairs) to enable consistent reporting. Use double‑entry bookkeeping for accrual systems or at least categorize cash receipts and payments to facilitate later adjustments. Accounting software often provides sample charts of accounts specific to farms.

Track Inventory & Prepaids Reliably

Accrual accounting hinges on accurate inventory counts and valuation. Differences in the value of stored crops, feed, and raised breeding livestock are a primary adjustment to income. Count and value grain, hay, feed, and livestock at the beginning and end of each year to adjust revenues. Similarly, prepaid expenses (fertilizer, seed, chemicals purchased ahead) should be recorded as assets and expensed when used. Maintaining spreadsheets or using software modules to log purchases and usage dates helps track these items. Regular physical inventories prevent theft, spoilage, and under‑ or over-valuation.

Match Costs to Harvests

A core principle of accrual accounting is matching expenses to the revenues they generate. When adjusting cash records, subtract increases in prepaid inputs from cash expenses and add changes in accounts payable. Record revenues when commodities are ready for sale, not necessarily when cash is received. Converting cash statements by adjusting for inventory and payables reveals true profitability and allows you to compare enterprises or fields. This practice also helps calculate net farm income from operations (NFIFO), which excludes extraordinary items like equipment.

Close Monthly & Review Key Performance Indicators (KPIs)

Don’t wait until year‑end to tally results. Conduct monthly closeouts, reconciling bank accounts, entering invoices, reviewing payables and receivables, and generating interim financial statements. Evaluate KPIs such as operating profit margin, debt‑to‑asset ratio, current ratio, and asset turnover. Small family farms often operate in the high‑risk zone with operating profit margins below 10 %. Monitoring KPIs helps identify problems early, adjust production practices, and negotiate with lenders.

Document Policies and Procedures

Write down accounting policies for your farm: when to record revenue, how to value inventory, which depreciation method to use, and how to handle bartering or share arrangements. Documenting these rules ensures consistency across years and with outside accountants. It also provides guidance if multiple family members or employees handle bookkeeping, reducing errors and disputes.

Keep Digital Records & Receipts

Use digital tools to capture and store receipts, invoices, and contracts. Cloud‑based software or apps let you photograph receipts in the field and attach them to transactions. Electronic records facilitate easier retrieval during farm audits and reduce the risk of losing paper documents. For cash accounting systems, digital storage still aids year‑end accrual adjustments, as you can quickly reference purchase dates and quantities.

Coordinate With Your CPA and Advisors

Engage a certified public accountant or farm management advisor who understands agricultural tax law and the Farm Financial Standards Council guidelines. They can help you choose an accounting method, prepare accrual adjustments, navigate depreciation rules and plan for transitions between methods. Collaboration also ensures that your records meet lender requirements and that you capitalize on allowable deductions.

Use Forecasts & Budgets

Develop cash flow forecasts and operating budgets. You need to create an annual cash flow budget to predict months with high expenses and plan for periods when cash flow is negative. Budgeting helps ensure you have funds to pay input suppliers and employees before harvest checks arrive. Forecasts also enable scenario planning for price fluctuations or yield changes, letting you make informed marketing and risk management decisions.

Reconcile & Verify Financial Records

Regularly reconcile accounting software with bank statements and loan statements to ensure accuracy and to catch discrepancies. Reconciliations verify that all transactions have been recorded and that accounts payable/receivable balances are correct. They also help identify fraud or errors early.

Manage Farm Accounting Effortlessly With Accounting Software

Digital accounting solutions streamline recordkeeping and reduce the risk of errors. Farm‑specific accounting software can handle both cash and accrual methods, automatically tracking inventory, prepaids, accounts receivable and payable, and generating financial statements at the click of a button.

Many systems integrate with banks for real‑time transaction feeds, link to payroll services and provide mobile apps for field use. Robust software also supports enterprise budgeting, enabling you to compare profitability by crop, field, or livestock group. For farmers who have historically used spreadsheets or paper ledgers, moving to a software platform may feel intimidating, but the time savings and accuracy gains quickly pay off.

At Folio3 AgTech, we offer farm accounting software designed specifically for growers and agribusinesses. Key features include:

- Cash and accrual reporting: Seamlessly switch between cash and accrual views to meet tax and management needs.

- Integrated inventory management: Track seeds, chemicals, feed, and harvested crops, adjust for gains and losses, and value inventory at market or cost.

- Accounts receivable and payable: Automatically record invoices, monitor due dates, and manage credit terms to improve cash flow.

- Budgeting and forecasting tools: Build annual and seasonal budgets, compare projections to actuals, and model what‑if scenarios.

- Mobile access and cloud storage: Enter data from the field, upload photos of receipts and invoices, and access reports anytime.

- CPA‑friendly exports: Generate reports that align with GAAP and Farm Financial Standards, simplifying collaboration with your accountant.

Ready to simplify your farm finances? Consult with our AgTech experts today or book a personalized demo to see how our software can transform your farm’s financial management.

FAQs

What is Farm Accounting and Why is it Different from Regular Accounting?

Farm accounting focuses on recording and analyzing financial data unique to agriculture to improve profitability and efficiency. Unlike standard business accounting, it handles agricultural-specific factors such as valuing crops and livestock, managing seasonal inventories, recording subsidies, and applying both cash- and accrual-based methods to reflect real farm performance and comply with agricultural tax rules.

Which Accounting Method is Best for Small Farms?

For most small farms, the cash accounting method works best because it’s simple, easy to maintain, and shows the farm’s actual cash position, vital for daily decisions and tax filings. Although accrual accounting gives deeper financial insight, the cash method is generally sufficient for smaller or less complex farming operations.

Can Farmers Switch Between Cash and Accrual Accounting?

Yes, farmers can switch between cash and accrual methods. Many use cash accounting for everyday management and tax purposes while converting records to accrual periodically to evaluate true profitability and long-term financial health.

How Does Farm Accounting Software Help with Tax Compliance?

Farm accounting software streamlines tax compliance by automatically organizing income, expenses, subsidies, and deductions. It generates ready-to-file reports aligned with agricultural tax requirements, helping farmers maximize deductions, maintain accurate records, and minimize filing errors.