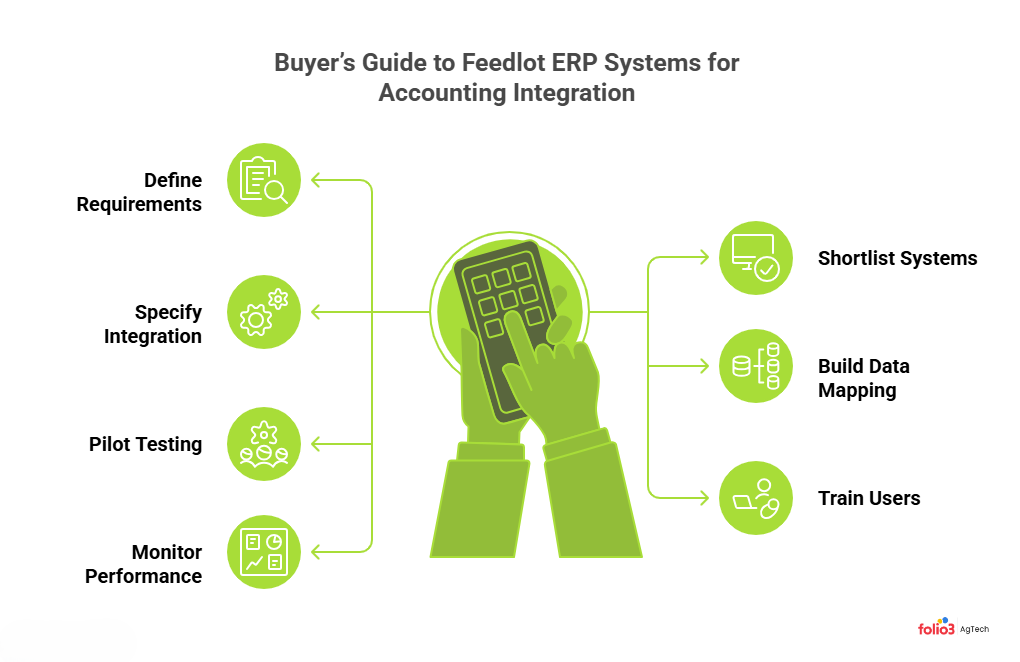

Selecting a feedlot ERP that truly connects with accounting isn’t about feature checklists, it’s about making every animal, feed, and contract event roll up to clean, auditable financials with minimal manual effort. In 2026, feedlot-ready platforms like eLynx and Turnkey’s Feedyard 3000 pair operational depth with cattle accounting, while enterprise ERPs such as NetSuite, Dynamics 365 Finance, SAP, Sage Intacct, and Oracle integrate via robust middleware to keep ledgers real time and traceable. This guide shows how to define integration requirements, shortlist the right platforms, and deploy with confidence; covering iPaaS choices, data mapping, pilot testing, and post-launch governance. For analytics and recall readiness, tools like Fusion Feedlot Insights and agribusiness ERP partners ensure end-to-end visibility and compliance across complex feedlot operations.

Define Feedlot and Accounting Integration Requirements

The first step is mapping how day-to-day feedlot events will trigger accurate financial entries and compliance outputs. Feedlot-event-to-accounting integration ensures that every operational action like animal movement, feed usage, or inventory changes, is matched by an automatic, traceable financial record in your accounting system.

Commercial feedlots should capture livestock receipts, pen transfers, lot splits/merges, feed issuance, treatments, weight adjustments, mortalities & contract settlements then mirror those events in accounting with the right debits, credits, and audit trails. Core capabilities to support this include lot/serial tracking, catch weight, First-Expired, First-Out (FEFO), and forward/backward traceability, alongside a real-time general ledger and immutable audit logs commonly emphasized in food and agribusiness ERP selections.

Use this matrix to align operations with finance before you evaluate systems:

| Feedlot event | Required accounting entries | Compliance/notes |

| Livestock receipt (purchase or custom feed) | Inventory capitalization and AP accrual; contract liability if custom | Import certificates, ownership, and source traceability |

| Pen transfer / lot split or merge | Inventory reclassification; cost layer adjustments | Maintain lot integrity and FEFO |

| Daily feed issuance | Issue to WIP/COGS; overhead allocation by ration/pen | Feed inventory decrement and nutrition records |

| Treatments / procedures | Expense or capitalize per policy; inventory decrement for meds | Link withdrawal periods and health records |

| Weight adjustment (scale events) | Cost revaluation and variance booking | Preserve catch weight history and reasons |

| Mortality event | Write-offs and carcass disposition accounting | Regulatory disposal records |

| Contract settlements (custom feed, grid, futures/hedge) | AR/AP, realized gains/losses; posting to GL by contract | Settlement docs attached to entries |

| Shipment / sale | COGS recognition, revenue, logistics costs | Forward/backward traceability preserved |

Getting this right early sets the foundation for ERP selection, integration design, and audit readiness.

Shortlist Feedlot ERP Systems by Operational and Financial Fit

Your shortlist should blend livestock-native capabilities with financial rigor and integration ease. Modern feedlot systems like eLynx’s operational suite emphasize feed, induction, and compliance workflows built for commercial yards (eLynx product suite). Turnkey’s Feedyard 3000 pairs cattle operations with dedicated cattle accounting to streamline settlements and GL alignment (Feedyard 3000 cattle accounting). Genius’s Feedlot Management System is another example focused on Australian feedlots and interoperability (Genius Feedlot Management System).

On the ERP side, livestock-ready deployments frequently use NetSuite in this vertical (NetSuite for cattle and livestock). CloudSuite Food & Beverage is often selected for catch weight and FEFO, while Sage Intacct, SAP, and Oracle Cloud ERP bring strong accounting and scale. Regional agribusiness advisors highlight how industry configurations and connectors close the gap between generic ERP and farm-gate realities (Agribusiness ERP guidance). Cross-industry food/dairy ERP roundups also reinforce the importance of batch/lot, FEFO, and catch weight in protein operations.

Concise definitions:

- Catch weight: recording the actual weight of each animal or product, not an average.

- Traceability: the ability to track the forward and backward history, application, or location of a product.

Comparison overview by operation size and feature coverage:

| ERP | Typical operation size | Catch weight / lot & FEFO support | Accounting + integrations | Notes |

| NetSuite | $5M–$500M | Via native modules and SuiteApps/partners | Strong APIs; connectors to major finance tools | Widely used in livestock and food sectors |

| Infor CloudSuite F&B | $50M–$500M+ | Native catch weight, lot/batch, FEFO | Enterprise-grade integration | Suited to protein and process manufacturers |

| Dynamics 365 Finance | $50M–$500M+ | Via ISVs/partners; strong lot/serial | Deep finance; robust integration | Agriculture-specialized extensions available |

| Sage Intacct | $5M–$100M | Requires add-ons for lot/catch weight | Leading midmarket accounting; prebuilt connectors | Often integrated with sector-specific ops tools |

| SAP (S/4HANA) | $500M+ | Strong batch/lot; catch weight via industry solutions | Enterprise integrations and controls | Best for complex, global enterprises |

| Oracle Cloud ERP | $500M+ | Strong finance; sector configs required | Enterprise integrations and controls | Scales for multi-entity, multi-currency |

Add analytics and reporting platforms where needed for production KPIs and recall readiness (Fusion Feedlot Insights).

Specify Integration Scope and Choose Middleware or iPaaS Platform

Direct, point-to-point connections are fragile. Instead, design a central integration layer using iPaaS, cloud-based middleware that connects different software systems using prebuilt connectors, automation, and real-time data syncs. Leading platforms such as Celigo, MuleSoft, SnapLogic, and Cleo offer connectors for major ERPs, strong error handling, and real-time/event-driven patterns (top ERP integration tools overview). Independent roundups highlight similar leaders with strengths in visual mapping, monitoring, and scalability (best ERP integration platforms).

Spend and payments platforms can also slot into your architecture with turnkey ERP connectors, easing AP/expense flow into the GL (Payhawk ERP integrations).

Checklist for choosing middleware/iPaaS:

- Supports real-time and event-driven integrations (webhooks, message queues).

- Visual data mapping with transformations, versioning, and reusable templates.

- Robust error handling (retries, dead-letter queues) and centralized logging.

- Prebuilt connectors for your ERP/accounting, data lake, EDI, and SFTP needs.

- Role-based access, secrets management, and audit trails for compliance.

- Scalability to peak season volumes and multi-entity routing.

Think of iPaaS as a central hub for operational and financial data rather than a mesh of brittle one-to-one connections.

Build Data Mapping and Validation Rules for Seamless Connectivity

Data mapping is the process of matching fields from the feedlot system to the accounting/ERP system. Before go-live, define transformation logic (units, currency, dimensions), rounding for catch weights, and reconciliation rules so totals match across systems at day-end and month-end. Reconciliation means ensuring transactions agree across platforms and match reality.

Embed validation checks so that the integration flags and quarantines issues before they hit the ledger; e.g., unknown pens, missing contract IDs, negative feed inventory, or out-of-range weights. Every error should be logged with context, retriable after correction, and tied to SLA targets.

Recommended flow:

- Feedlot event captured (e.g., receipt, feed issue, mortality) with lot, weight, and contract metadata.

- Event published to iPaaS (API/webhook), enriched with master data (vendor, pen, item, cost center).

- Transform and validate (units, rounding, cost allocation); route errors to review queues.

- Post to ERP/accounting (inventory, WIP/COGS, AP/AR, GL) with attachments for audit.

- Acknowledge back to the feedlot system; update operational status.

- Daily automated reconciliation reports; exceptions resolved before close.

Pilot Testing with Real-World Feedlot and Finance Scenarios

A hands-on pilot with representative herds and sites validates the end-to-end flow and surfaces gaps before they become production issues. Include recall simulations, period close dress rehearsals, and multi-entity settlements. Analytics layers should demonstrate complete lineage from pen to posted GL and back, supporting quick investigations and compliance (Feedlot analytics and insights).

What to test:

- Weight adjustments, mortalities, and carcass dispositions.

- Pen transfers, lot splits/merges, and FEFO consumption.

- Daily feed issues, ration costs, and overhead allocations.

- Purchase receipts, contract settlements, and AR/AP posting.

- Shipment/invoice flows and revenue recognition.

- Audit trails, attachments, and traceability chain integrity.

Train Users and Manage Support for Staged Deployment

Success hinges on well-prepared users across operations and finance. Deliver role-based training that covers data entry standards, exception handling, reconciliation, and tracing tools with live examples from your pilot. A staged rollout—by site, species, or process, limits disruption, with a helpdesk, SLAs, and clear escalation paths to resolve issues quickly.

User readiness checklist:

- Permissions validated; SSO and roles aligned to duties.

- Process walk-throughs completed for daily ops and month-end.

- Role-based reports and dashboards pinned and understood.

- Support channels, SLAs, and knowledge articles accessible.

For a deeper playbook on change management and CFO priorities in feedlot ERP rollouts, see this practical guide (Feedlot ERP guide for CFOs).

Monitor Performance, Reconciliation, and Optimization Post Launch

Post-launch, monitor integration health as closely as you monitor feed conversion. Track data flow latency, reconciliation exceptions, coverage of operational-to-financial mappings, and traceability chain integrity. Set automated alerts and dashboards—a dashboard is a visual display summarizing real-time operational and financial metrics, to keep teams proactive, not reactive.

Establish quarterly optimization cycles:

- Review exceptions and data quality trends; tighten validation rules.

- Gather user feedback; streamline screens, defaults, and automations.

- Update mappings for new contracts, products, or entities.

- Re-certify controls and audit trails ahead of regulatory reviews.

If you need a partner experienced in agriculture-native integrations and Dynamics 365, explore our approach to agriculture ERP deployment (Folio3 Agriculture ERP) and feedlot solutions.

FAQs

What Are The Key Operational Events To Integrate With Accounting Systems?

Key events include livestock receipts, transfers, weight adjustments, contract settlements, inventory changes, and mortality records that each must trigger accurate, auditable accounting entries.

How Does Middleware Improve Feedlot ERP And Accounting Integration?

Middleware acts as a bridge between feedlot operations and accounting systems, enabling real-time data transfer, automated error handling, and scalable integration without the need for complex custom code.

What Should I Consider When Choosing Between Cloud And On-Premise ERP?

Consider your organization’s IT resources, remote access needs, data security policies, and scalability requirements when deciding between flexible cloud solutions or more controlled on-premise ERP deployments.

How Do Feedlot-Specific Features Affect Financial Reporting Accuracy?

Features like catch weight, traceability, and lot-level accounting allow feedlot finances to closely reflect actual operations, reducing manual entry and improving the accuracy and auditability of financial reports.

What Are Best Practices For Data Governance In Feedlot ERP Implementations?

Best practices include clearly defining data ownership, consistent validation rules, regular reconciliation processes, and providing secure access controls to ensure reliable, compliant financial outcomes.