Managing finances in the livestock sector can be complex, with numerous variables to track—from expenses and income to compliance and profitability. For agribusiness finance managers, using the right tools is essential to streamlining operations and making data-driven decisions. Agriculture accounting software is a must-have solution, offering powerful features that simplify financial management and provide deeper insights into business performance.

In this blog, we will explore why accounting software tailored for the agricultural industry is essential for finance teams and how it can help transform financial management in livestock operations.

5 Reasons Why Agriculture Accounting Software Important for Livestock Finance Managers

For finance managers in the livestock sector, handling complex financial data, managing budgets, and ensuring regulatory compliance can be daunting without the right tools. Agriculture accounting software simplifies these tasks, providing the insights and efficiency needed to make informed decisions.

Let’s delve into the five key reasons why agriculture accounting software is crucial for livestock finance managers:

1. Access Farm Finances Anytime, Anywhere

Finances in livestock management can be incredibly complex and time-consuming. From tracking income generated through animal sales to managing day-to-day expenses such as feed, labor, and healthcare, finance managers face the challenge of maintaining accuracy and detail.

Manual processes often lead to errors and missed opportunities, negatively affecting the business’s financial health. This is where agriculture accounting software becomes essential. Accounting software ensures that finance professionals can manage their operations more effectively and precisely by automating routine tasks and providing a comprehensive overview of the economic landscape.

Why It’s Important?

Manual financial management is complex and time-consuming for agribusinesses, especially those in livestock farming. From tracking income from animal sales to managing expenses like feed, healthcare, and labor, it’s easy to miss critical details or make errors.

Benefits of Software

Agriculture accounting software addresses these challenges by automating repetitive and time-consuming tasks. With such tools, finance professionals gain access to a real-time financial overview, enabling more effective monitoring and management of farm income and expenditures. Key benefits include:

- Streamlined Income and Expense Tracking: Seamlessly track revenues from livestock sales and operational expenses like feed and labor.

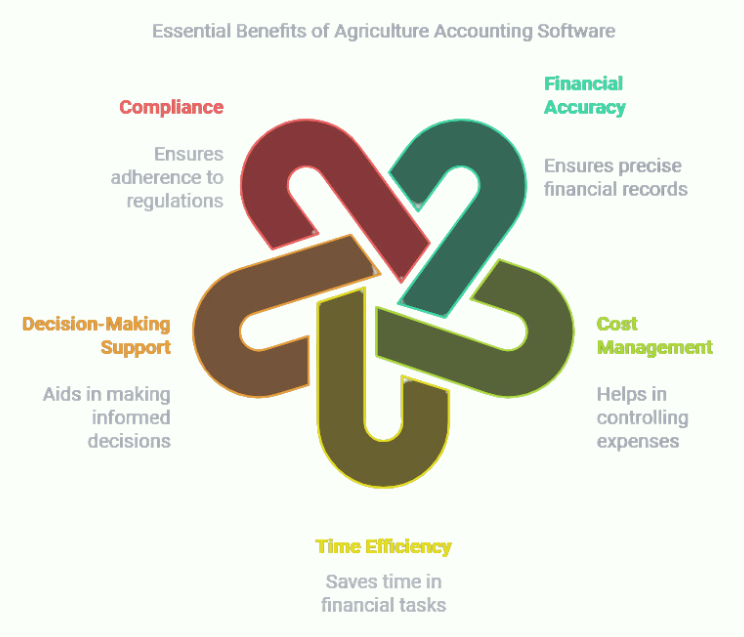

- Budgeting and Forecasting: Create accurate budgets and forecasts tailored to your farm’s requirements.

- Real-Time Reporting: Generate instant financial reports to analyze profitability and performance metrics.

- Error Reduction: Minimize mistakes associated with manual data entry and complex calculations.

Key Insight

Automating financial management with specialized tools like Folio3’s Farm Accounting Software enhances accuracy and saves valuable time. This allows finance teams to shift their focus from tedious administrative tasks to strategic planning and decision-making. The result? Improved efficiency using agriculture accounting software, better financial control, and increased profitability.

Folio3’s tailored solution empowers agribusinesses to optimize their financial processes and drive growth, ensuring every dollar spent is a step toward achieving your operational goals. Folio3’s Farm Accounting Software is specifically designed to cater to the unique financial needs of agribusinesses.

Integrating essential accounting functions into a single, user-friendly platform eliminates reliance on error-prone spreadsheets and disparate software systems. Key features include:

- Real-Time Insights: Access live data and generate reports instantly for timely decision-making.

- Intuitive Interface: A user-friendly design ensures that finance managers can quickly adopt and use the software.

- Customized Reporting: Tailor financial reports to meet the specific demands of your farm operations.

- Integration Capabilities: Easily integrate with other essential farm management tools for a seamless operational experience.

2. Ensure Compliance with GAAP Standards

Staying compliant with Generally Accepted Accounting Principles (GAAP) is vital for agribusinesses, especially in livestock farming, where financial complexities arise due to fluctuating revenues, unpredictable expenses, and market volatility. GAAP compliance ensures accurate financial reporting, bolsters stakeholders’ trust, and prepares businesses for audits and external reviews.

Finance People in Agribusiness

Managing compliance with GAAP can be particularly challenging for finance professionals in agribusiness. GAAP compliance adds a layer of complexity, requiring consistent financial standards while managing these variables. They often deal with:

- Variable Revenue Streams: Income from livestock sales can fluctuate due to market demand, seasonality, and global trends.

- Complex Expense Tracking: Costs like feed, labor, and veterinary care are unpredictable and must be meticulously recorded.

- Stakeholder Accountability: Accurate and transparent financial records of livestock businesses are essential for securing loans, attracting investors, and satisfying regulatory requirements.

Software Features That Help

Agriculture accounting software simplifies compliance by integrating GAAP-compliant features that automate and streamline financial management:

- Automated Record-Keeping: Tracks income and expenses aligned with GAAP standards, reducing manual errors.

- Standardized Financial Reports: This department generates essential reports like income statements, balance sheets, and cash flow reports, ensuring consistency.

- Audit Trails: Maintains detailed records of financial transactions, making audits straightforward and efficient.

- Cost Analysis Tools: Identifies expense trends, allowing managers to ensure costs are accurately allocated and reported.

- Real-Time Data Access: Ensures finance teams have immediate insights into financial performance, aiding compliance and operational decisions.

Real-Life Application

Imagine a livestock farm facing an upcoming audit while trying to secure funding for expansion. Using agriculture accounting software, the finance team can:

- Generate GAAP-compliant reports to satisfy auditors and lenders.

- Access detailed transaction histories to provide transparency and build lender confidence.

- Analyze financial trends to identify areas for cost reduction and improved profitability.

The software simplifies compliance and provides actionable insights, enabling the farm to secure necessary funding and streamline operations simultaneously. Folio3’s Farm Accounting Software is designed to meet the specific needs of agribusinesses, offering tools for seamless GAAP compliance, real-time financial monitoring, and actionable insights. Agribusiness finance teams can use advanced software to maintain transparency, improve operational efficiency, and build stakeholder trust.

3. Work Together Seamlessly on Farm Financials

Effective collaboration is essential in managing farm financials, especially in livestock farming, where the industry’s cyclical nature demands synchronized decision-making among stakeholders. From breeders to finance managers, everyone benefits from tools that promote seamless data and insights sharing to adapt to fluctuating costs and revenues.

Importance in Farm Financing

With proper collaboration, miscommunication or siloed data can lead to efficient resource allocation, cash flow issues, and missed growth opportunities. Farm financing relies on accurate, timely collaboration to address financial challenges such as:

- Seasonal Variability: Livestock farming is affected by breeding cycles, feed availability, and market demand, requiring stakeholders to align on financial planning.

- Resource Allocation: Decisions about feed, labor, and veterinary expenses must be informed by current financial conditions and future forecasts.

- Risk Mitigation: Collaboration ensures that all parties can prepare for potential risks, such as unexpected expenses or cash flow shortages, by pooling insights and resources.

Software Advantages

Agriculture accounting software fosters teamwork by enabling shared access to real-time financial data, ensuring all stakeholders are on the same page:

- Centralized Financial Data: Teams can access up-to-date budgets, reports, and forecasts from a single platform, eliminating miscommunication.

- Role-Based Permissions: Assign team members specific access levels to secure sensitive financial information while promoting transparency.

- Dynamic Budgeting and Forecasting: Collaborative tools allow multiple stakeholders to contribute to financial planning, improving budget accuracy and adaptability.

- Real-Time Reporting: Stakeholders can monitor financial performance together, ensuring timely decisions based on the latest insights.

- Integration with Communication Tools: Many software solutions integrate with enterprise communication platforms, enabling teams to discuss financial strategies in real time.

Real-Life Application

Consider a livestock farm preparing for a seasonal surge in feed costs. With agriculture accounting software, the finance team can collaborate with operations managers to:

- Create dynamic budgets that account for projected price increases.

- Adjust forecasts to allocate funds for unexpected veterinary care or labor costs.

- Share reports and updates with stakeholders to ensure everyone is aligned on financial priorities.

Folio3’s Agriculture Accounting Software enhances collaboration in farm financial management. By offering centralized data access, dynamic forecasting tools, and customizable reports, teams can work together effectively, ensuring smooth operations and long-term economic stability.

4. Tailor Accounting Workflows to Your Needs

Customizable accounting workflows are vital for agribusinesses, as they provide flexibility to adapt to unique financial challenges and regulatory requirements. In livestock farming, managing diverse expenses, revenue streams, and compliance mandates requires workflows that can be tailored to meet specific operational needs.

Compliance Challenges

Failure to comply with these regulations can result in penalties, audits, and financial setbacks, making streamlined and customizable workflows necessary. Agribusinesses face complex regulatory landscapes that include:

- Tax Laws: Farmers must adhere to specific requirements like IRS Schedule F for reporting farm income and expenses.

- Financial Reporting Standards: Compliance with Generally Accepted Accounting Principles (GAAP) is necessary for transparency and accountability.

- Industry-Specific Regulations: Rules related to environmental impacts, subsidies, and farm labor laws add layers of complexity.

How does Software help?

Agriculture accounting software simplifies compliance and enhances workflows in the following ways:

- Built-In Regulatory Updates: Software automatically integrates the latest tax laws and accounting standards, keeping your business compliant.

- Customizable Workflows: Create tailored processes for tracking revenue, managing deductions, and preparing financial reports based on your farm’s needs.

- Automated Reporting: Quickly generate compliance-ready financial statements, tax returns, and audit trails.

- Audit Preparedness: Maintain detailed, accessible records to streamline audits and reduce stress during regulatory inquiries.

- Deduction Tracking: Real-time insights into eligible tax deductions and credits help optimize financial benefits while staying compliant.

Key Value

Customizable accounting workflows streamline compliance and improve operational efficiency. They allow agribusinesses to adapt quickly to changes in regulations or business needs while reducing the risk of human error.

At Folio3 AgTech, our agriculture accounting software provides flexibility and peace of mind by combining robust compliance tools with customizable workflows. With real-time updates, automated reporting, and audit-ready record-keeping, our software ensures your business operates efficiently while adhering to the highest financial and regulatory standards.

5. Centralized Financial Management Across Farms

Agribusinesses with multiple farm operations often face challenges in consolidating financial data, tracking performance metrics, and ensuring consistent reporting. A single, integrated software solution simplifies the management of these complexities, providing a unified platform to oversee finances across all locations.

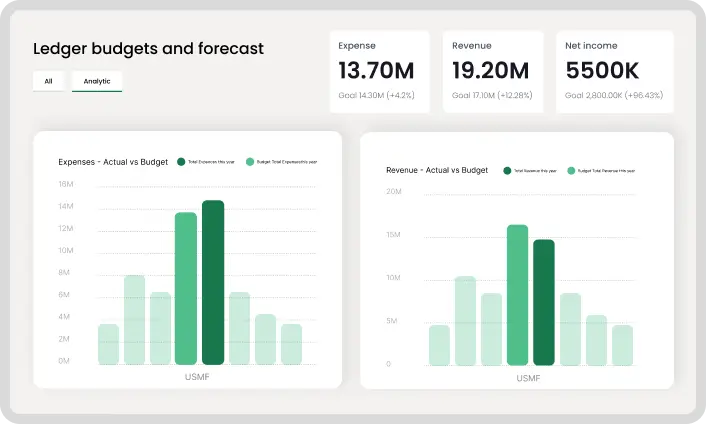

Agriculture accounting software provides a comprehensive view of livestock performance, offering detailed reports that help finance professionals assess which areas of the business are most profitable and which may need improvement. This level of insight allows finance managers to make more strategic decisions, allocate resources more effectively, and ultimately drive greater profitability across the operation.

Why It’s Important?

Managing multiple farms involves juggling diverse revenue streams, operational expenses, and regulatory requirements. Without centralized oversight, farms risk:

- Inconsistent Reporting: Discrepancies in how finances are tracked across farms can lead to inefficiencies and errors.

- Limited Visibility: Lack of real-time data across locations makes assessing performance and identifying issues difficult.

- Resource Allocation Challenges: Distributing resources effectively across farms becomes a guessing game without consolidated insights.

A single platform to manage finances streamlines operations, reduces errors, and improves overall efficiency, making it a critical asset for agribusinesses.

Analytics Features

Agriculture accounting software equips finance managers with powerful analytics and reporting tools that provide a deep dive into livestock performance. These tools track key metrics such as growth rates, feed efficiency, health management, and overall productivity. Agriculture accounting software comes equipped with robust analytics and reporting tools that provide actionable insights, including:

- Farm-Specific Metrics: Monitor growth rates, feed efficiency, health management, and productivity metrics unique to each farm.

- Cross-Farm Comparisons: Evaluate performance across multiple locations to identify underperforming farms or practices.

- Expense Optimization: Pinpoint inefficiencies in cost areas like feed, labor, and equipment usage.

- Profitability Insights: Track revenue and profitability for each farm, helping prioritize investments and operational adjustments.

- Real-Time Dashboards: Get instant updates on financial health across all farms to make informed, timely decisions.

Outcome

Folio3’s agriculture accounting software consolidates financial management for all farms into one easy-to-use platform. Advanced analytics, real-time tracking, and centralized reporting empower agribusinesses to operate efficiently, make data-driven decisions, and achieve long-term growth. With these advanced analytics, agribusinesses can achieve:

- Improved Decision-Making: Gain insights into performance trends and address inefficiencies proactively.

- Enhanced Resource Allocation: Distribute resources strategically based on farm-specific needs and performance.

- Increased Profitability: Optimize operations to boost revenue and reduce costs.

Conclusion

Agriculture accounting software is not just a tool but a game-changer for livestock finance professionals. From streamlining financial management to ensuring compliance, optimizing profitability, and gaining deeper insights into livestock performance, the software empowers finance teams to make smarter, data-driven decisions. So, using these solutions can transform how your agribusiness handles finances and ultimately boost your bottom line.

FAQs

What Are Some Examples Of Agriculture Accounting Software?

Folio3’s agriculture accounting software is an excellent example. It offers features like expense tracking, budgeting, and livestock performance analysis to streamline financial management in agribusinesses.

How Does Agriculture Accounting Software Enhance Profitability?

By providing real-time financial data and analytics, agriculture accounting software helps finance professionals make informed decisions, cut costs, and optimize profitability.

Why Is Budgeting And Forecasting Important For Livestock Operations?

Effective budgeting and forecasting ensure livestock operations have the financial resources to handle seasonal fluctuations, plan for future expenses, and maintain profitability year-round.

How Can Agriculture Accounting Software Help With Regulatory Compliance?

The software automatically updates with the latest regulatory requirements, generates compliant financial reports, and tracks necessary deductions, helping businesses stay compliant and avoid penalties.

What Insights Can Livestock Finance Managers Gain From Accounting Software?

Agriculture accounting software provides performance insights on livestock, including health, productivity, and profitability, which helps finance managers make better resource allocation decisions.