The agriculture sector is evolving rapidly, and so are its financial complexities. Traditional manual accounting systems may have sufficed for small-scale operations, but the need for accuracy, scalability, and actionable insights grows exponentially as farms expand. Transitioning to farm accounting systems can transform how you manage your finances, helping you save time, reduce errors, and make informed decisions.

In this guide, we’ll explore why shifting from manual to automated accounting systems is essential, highlight the benefits, and provide actionable steps to ensure a smooth transition. Let’s dive in!

Why Transition from Manual Bookkeeping to Farm Accounting Systems?

As farming operations grow more complex, traditional manual bookkeeping methods often need to catch up in managing the demands of modern agricultural finance. The challenges can quickly overwhelm outdated manual systems, from tracking multiple revenue streams to maintaining compliance with tax regulations.

Transitioning to farm accounting systems offers a streamlined, accurate, and scalable solution, ensuring your financial management evolves alongside your business. Let’s explore why this transition is crucial for today’s farmers.

Increased Complexity in Agriculture Finance

Modern farms have multiple revenue streams, complex supply chains, and varied expenses. Managing these through a manual system increases the risk of errors and limits the ability to analyze data comprehensively.

Cost of Manual Errors

Human errors in manual farm bookkeeping can lead to inaccurate financial statements, tax miscalculations, and poor financial planning. These mistakes can result in costly penalties or missed growth opportunities.

Scalability Needs

As your farm grows, so does the volume of financial data. Manual systems lack the efficiency to handle such growth, making automated accounting systems necessary for scalability and efficiency.

Core Benefits of Farm Accounting Systems

Transitioning from a manual accounting system to an automated accounting system unlocks numerous advantages for agricultural businesses. By transitioning to an automated farm accounting system, you can overcome the limitations of manual accounting systems while gaining a competitive edge in managing your farm’s financial health.

Let’s delve into how these systems can revolutionize your financial management processes:

Time Efficiency

Farm accounting systems streamline repetitive and time-intensive tasks such as generating invoices, tracking expenses, and managing payroll. These automated accounting systems eliminate manual data input, allowing farmers to focus on strategic operations like crop planning and supply chain optimization. This efficiency saves time and reduces labor costs associated with manual bookkeeping.

Minimizing Errors

One of the most significant drawbacks of manual accounting systems is their susceptibility to human errors. These errors, from data entry mistakes to calculation mishaps, can lead to accurate financial records and better decision-making. By contrast, automated accounting systems leverage advanced algorithms to ensure precision in financial tracking, reducing the risk of costly errors and discrepancies.

Compliance with Tax Regulations

Staying compliant with tax regulations is a critical aspect of farm management. Farm accounting systems often have tax compliance features, such as automated tax calculations and reporting tools. These features help farmers navigate complex tax codes, ensure timely filings, and avoid penalties. Additionally, many systems offer multi-entity accounting capabilities, simplifying tax preparation for diversified operations.

Data Security and Accessibility

The transition to farm accounting systems also addresses data security concerns. Cloud-based platforms provide robust encryption, regular backups, and restricted access controls, safeguarding sensitive financial data. Furthermore, these systems enable secure, remote access to your financial records, allowing you to manage your accounts from any location, including the office, the field, or during travel.

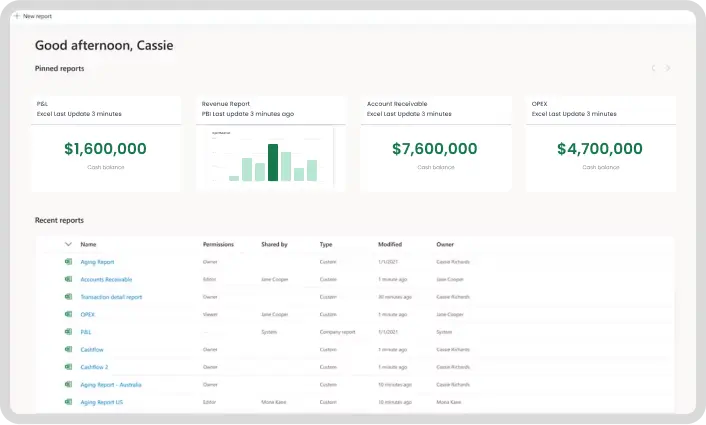

Actionable Insights via Dashboards

Modern farm accounting systems include intuitive data visualization dashboards that present real-time financial data in a visually engaging format. These dashboards provide insights into critical metrics such as cash flow, profit margins, and expense trends. Farmers can make informed, data-driven decisions to optimize costs, improve productivity, and maximize profitability with this data.

How Accounting Software Prevents Overspending?

Effective financial management is crucial for any business, and preventing overspending is one of the key challenges many face. Managing expenses can be particularly complex for agricultural companies due to fluctuating costs and variable income. Farm accounting systems offer a range of tools that help prevent overspending, ensuring your financial stability. Let’s look at the need for accounting systems in agriculture to keep your finances in check.

1. Budget Monitoring Tools

Farm accounting systems empower businesses to set precise budgets for various operations, from seed purchases to labor costs and equipment maintenance. These budgets act as financial guardrails, guiding the farm’s spending across different categories.

The software constantly monitors your expenditures and sends automatic alerts when you’re nearing or exceeding the predefined limits. This feature allows you to take corrective action before overspending becomes an issue, ensuring you stay within your financial targets.

In contrast to a manual accounting system, where tracking expenses and setting up budgets can be tedious and prone to errors, automated accounting systems provide real-time monitoring and updates. This means that whether you’re dealing with seasonal fluctuations or unexpected expenses, automated accounting systems can help you adjust your spending dynamically without the risk of missing crucial financial details.

2. Vendor and Inventory Oversight

Managing vendor relationships and inventory levels is another area where farm accounting systems are crucial in preventing overspending. The software helps you track vendor payments, ensuring that you don’t overpay for supplies or pay late fees. Integrating all vendor transactions into one system makes it easier to identify discrepancies or unnecessary purchases, which helps in renegotiating contracts or avoiding duplicate orders.

Inventory management is equally important. The system tracks stock levels in real time so you don’t overstock or order supplies you already have. It can even provide automated reorder alerts when stock is low, ensuring you maintain the optimal inventory level without overcommitting capital. This tight control over inventory helps reduce waste and unnecessary expenditures, maximizing efficiency and profitability.

Unlike a manual accounting system, which may require manual checks and reconciliations to ensure accuracy in inventory and vendor transactions, automated accounting systems streamline this process, offering a faster and more efficient way to manage these critical areas.

3. Integration with Cost-Analysis Tools

One of the most valuable features of modern farm accounting systems is their integration with cost-analysis tools. These automated accounting systems pull data across your operations and analyze spending patterns. By evaluating expenses in detail, these tools help you identify areas where costs are rising or exceeding expectations.

Cost-analysis tools allow you to break down your expenditures by category, enabling you to spot trends or inefficiencies. For example, you might discover that a certain process costs more than necessary or that an alternative supplier offers better rates for the same materials.

With this insight, you can adjust your practices, negotiate better deals, or cut back on unnecessary spending. Integrating cost-analysis features turns data into actionable intelligence, making it easier to make informed decisions and control your finances.

Unlike a manual accounting system, where cost tracking and analysis may involve time-consuming calculations and are often subject to human error, automated accounting systems provide seamless integration with cost-analysis tools, offering real-time insights that help you make informed decisions.

Addressing Tax Season Challenges with Farm Accounting Software

Tax season can be one of the most stressful times for farmers as they navigate complex financial records, receipts, and tax filings. The traditional manual accounting systems can be time-consuming, error-prone, and overwhelming during this period.

However, farm accounting systems offer an efficient, automated approach to ease the burden. These systems provide several features designed to simplify tax preparation, reduce errors, and ensure timely compliance. Let’s explore how automated accounting systems can help farmers tackle tax season challenges.

1. Centralized Data Storage

One of the biggest advantages of farm accounting systems is their ability to consolidate all your financial data in one central location. Unlike a manual accounting system, where economic data may be scattered across various spreadsheets or physical records, automated accounting systems integrate all your data into a unified system.

This centralized data storage ensures that every financial transaction—related to income, expenses, or tax deductions—can be easily accessed and reviewed during tax season. Farm owners can quickly retrieve the necessary documents for filing taxes by storing all financial information in a single place.

2. Automated Report Generation

Generating tax reports manually can be tedious and prone to mistakes, especially when managing a farm’s complex financial data. However, farm accounting systems eliminate this challenge by offering automated report generation. With just a few clicks, automated accounting systems can generate tax reports, income statements, and expense summaries, ensuring accuracy and compliance with tax regulations.

These reports are critical during tax season, providing a comprehensive view of your farm’s financial health. Instead of manually compiling data from multiple sources, automated accounting systems streamline the process, significantly reducing the risk of errors. The ability to generate these reports quickly ensures that you have ample time to review them and make any necessary adjustments before filing your taxes.

3. Multi-Entity Accounting

Farm accounting systems provide a unique advantage for farmers who manage multiple entities or operate in different locations. Automated accounting systems simplify consolidating financial data from various entities or locations, allowing farmers to prepare taxes more efficiently. Whether you’re managing separate farms, businesses, or income streams, these systems can integrate all data into one cohesive record.

With multi-entity accounting, farm accounting systems ensure that all your operations are accounted for, reducing the risk of overlooking important details when preparing taxes. The system allows you to consolidate income, expenses, and other financial data from different entities or locations, making tax preparation more streamlined and accurate. This feature is particularly beneficial for farmers with complex operations, as it removes the hassle of maintaining separate records for each entity under a manual accounting system.

Steps to Transition from Manual to Automated Systems

By transitioning to automated accounting systems, farmers can streamline tax season processes, reduce errors, and improve financial management, ultimately saving time and enhancing compliance. If you’re ready to transition from a manual accounting system to an automated accounting system, follow these steps:

1. Assess Current Accounting Needs

Evaluate your existing processes, identify pain points, and list features you need in a farm accounting system.

2. Set Goals for the Transition

To measure the transition’s success, define clear objectives, such as reducing errors, saving time, or improving tax compliance.

3. Evaluate Software Options

Research various farm accounting systems to find one that aligns with your needs, budget, and scalability requirements.

4. Data Migration Plan

Prepare a comprehensive plan to transfer data from your manual accounting system to the new software. This may involve cleaning up data and ensuring accuracy before migration.

5. Training and Change Management

Invest in training for your team to familiarize them with the new system. Address resistance to change by highlighting the benefits and providing ongoing support.

Overcoming Common Challenges

Transitioning from a manual to an automated accounting system can present challenges, but the long-term benefits far outweigh the initial hurdles. By addressing these challenges proactively, you can ensure a successful transition to farm accounting systems that streamline operations, improve efficiency, and enhance data security, leading to long-term benefits for your business.

Here’s how to overcome some of the most common challenges:

1. Initial Cost of Transition

The upfront cost of implementing an automated accounting system can seem daunting, especially compared to maintaining a manual accounting system. However, view it as an investment that will pay off over time. Farm accounting systems help reduce administrative costs, minimize errors, and save time, leading to significant long-term savings. Automating repetitive tasks will boost efficiency and free up resources to focus on more strategic areas of your business.

2. Learning Curve

Adopting a new system often comes with a learning curve, as employees may need time to familiarize themselves with the software’s features and workflows. Choose a user-friendly farm accounting system to ease this transition and ensure your team receives comprehensive training. Offering ongoing support and addressing any issues promptly will help reduce resistance to change and ensure a smooth transition to automated accounting systems.

3. Data Privacy Concerns

When transitioning to automated accounting systems, it’s important to address any concerns regarding data privacy. Ensure the software you select complies with data protection regulations and offers robust security features. Look for systems that provide encrypted data storage, secure access controls, and regular security updates to protect sensitive financial information.

Conclusion

Transitioning from manual bookkeeping to a farm accounting system is a transformative step that modernizes your farm’s financial management. Automated systems empower farmers to focus on what they do best—growing their business. They reduce errors, save time, and offer actionable insights.

If you’re ready to switch, explore Folio3’s farm accounting software to find a solution tailored to your needs.

FAQs

What is a Farm Accounting System?

A farm accounting system is software designed to manage farms’ unique financial needs, including budgeting, expense tracking, tax compliance, and financial reporting.

How Do Farm Accounting Systems Improve Efficiency?

They automate repetitive tasks, reduce errors, and provide real-time insights through dashboards, helping you make informed decisions quickly.

Is It Expensive To Implement a Farm Accounting System?

While there is an initial cost, the long-term benefits, including time savings, reduced errors, and better financial management, far outweigh the investment.

Can I Integrate My Farm Accounting System With Other Tools?

Yes, many systems integrate seamlessly with tools for cost analysis, inventory management, and tax preparation.

How Secure Is Farm Accounting Software?

Most systems offer advanced security features like encryption and regular backups to protect your data from breaches or loss.

How Do You Shift From Manual Accounting To Computerized Accounting?

To shift from manual to computerized accounting, evaluate your needs and select the right farm accounting system. Then, migrate your existing data into the new system, ensuring accuracy and providing proper training for your team. Finally, monitor the system’s performance to ensure smooth adoption and address any issues as they arise.

How Do You Transition To a New Accounting System?

Transitioning to a new accounting system involves evaluating your current processes, setting clear goals, and selecting the right software. You should migrate your data carefully and train your team on the new system. Then, monitor the system’s performance to ensure a smooth transition and optimize operations.